BROWSE OUR BLOGS TO LEARN MORE ABOUT RETIREMENT PLANNING, TAXES, AND MORE!

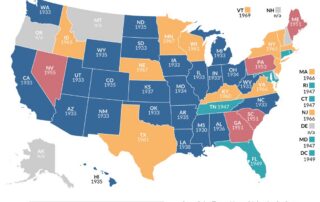

A History of the Sales Tax

Before we take a peek into the past to see how sales tax became a part of our lives, let’s define our terms. Sales tax is a tax on the sale or exchange of an item or service and is usually paid by the consumer or purchaser. It is a source of revenue for state and local governments to fund [...]

Understanding the Tax Treatment of Life Insurance in Retirement

When people think about retirement planning, they often focus on IRAs, 401(k)s, and investment portfolios. But for many retirees, life insurance can play a strategic role, especially when it comes to navigating taxes. Whether you're considering a new policy, already own one, or are weighing options for estate planning, it's important to understand how life insurance is treated from a [...]

4 Key Birthday Milestones in Retirement—and What They Mean for Your Financial Strategy

Birthdays in retirement aren’t just a reason to celebrate—they’re also checkpoints that can unlock new financial opportunities (or trigger important deadlines). From Social Security eligibility to Required Minimum Distributions (RMDs), several key ages mark turning points in your retirement journey. Here are four birthday milestones every retiree should know—and what they mean for your financial strategy. Age 59½ – Penalty-Free [...]

Does Retirement Have to Happen All at Once?

Imagine transitioning into retirement not as a sudden leap but as a gradual, comfortable glide. This approach, known as phased retirement, is gaining popularity. It allows people like you to reduce working hours over time, allowing a smoother shift from full-time employment to full-time retirement... and it even has financial benefits. But doing it right is key. What is Phased [...]

How to Choose the Right Life Insurance Policy for Your Family’s Future

Life insurance is one of those topics many of us tend to avoid, perhaps because it feels like something we don't need to think about until absolutely necessary. But here's the truth: life insurance is a crucial part of securing your family's financial future. Whether you're just starting out in life, building your career, or nearing retirement, the right life [...]

How to Tell if You’re Taking on Too Much Risk (Or Too Little!)

Imagine this: You check your retirement account and see a drop in value. Your stomach tightens. Thoughts race through your mind: Should I sell now before it gets worse? Is my retirement in danger? If you’ve ever felt this way, you may be carrying more risk in your financial plan than you’re comfortable with. On the other hand, some retirees [...]

How to Use Your HSA Wisely in Retirement

Retirement is a time to enjoy the fruits of your labor. But amidst the dreams of travel and newfound hobbies, there's one aspect that often looms large: healthcare expenses. Enter the Health Savings Account (HSA), a tool that, when wielded wisely, can be a retiree's secret weapon in managing medical costs and enhancing financial well-being. The Triple Tax Advantage: A [...]

Post-Tax Season Tips for Pre-Retirees

Tax season is behind us, but for pre-retirees—those within 10-15 years of retirement—this is the perfect time to reassess financial strategies. The decisions you make now can significantly impact your retirement lifestyle, taxes, and financial security. Here are five key post-tax season moves to keep you on track. Tax-Advantaged Retirement Contributions If you’re still working, post-tax season is a great [...]

The Max it Out

Approach

The Max it Out approach is centered in tailoring streamlined retirement planning tactics to meet our clients’ needs that align with their goals and values. We look to emphasize long-term stability, tax efficiency, and the maximization of the hard-earned resources of those we service. Our ideal client values conservative financial strategies and takes pride in their self-made success.

Retirement Planning

Retirement planning is a crucial journey, no matter where one stands in life’s trajectory. At every stage, it’s about offering tailored guidance, empowering individuals with the right tools, and providing comprehensive services to enable a retirement that aligns with personal aspirations and dreams. Our focus remains unwavering—to support and equip individuals with the knowledge and resources needed to pave the way for a fulfilling retirement. We understand the significance of this phase and strive to ensure that each person can retire confidently and comfortably.

Income Strategies

Ensuring a consistent and guaranteed stream of income is crucial to maintaining one’s lifestyle and financial security. Annuities are often considered a key component of income strategies aimed at providing guaranteed lifetime income. Fixed Index Annuities guarantee a minimum interest rate, shielding the principal from market losses, and can provide a way to grow retirement savings while maintaining a level of security.

Tax Strategies

Integrating astute tax strategies into our comprehensive financial planning is a cornerstone of our approach. We prioritize a thorough understanding of tax-efficient methods and their integration into personalized financial plans. By strategically employing various tax-saving techniques, such as tax-deferred investment accounts, tax-efficient asset allocation, or maximizing deductions and credits, individuals can potentially minimize their tax liabilities. This proactive approach not only helps in reducing the immediate tax burden but also fosters long-term financial stability, allowing for the preservation and growth of assets, thereby bolstering overall financial health.